The State Revenue Service, like other market control authorities in Latvia, shall follow the principle “Consult first”, introduced in the state administration. The purpose of the principle “Consult first” is to achieve that “rules of the game” or applicable requirements are clearly understandable to entrepreneurs. Fulfilment of requirements rather than punishment must be ensured within the framework of control activities.

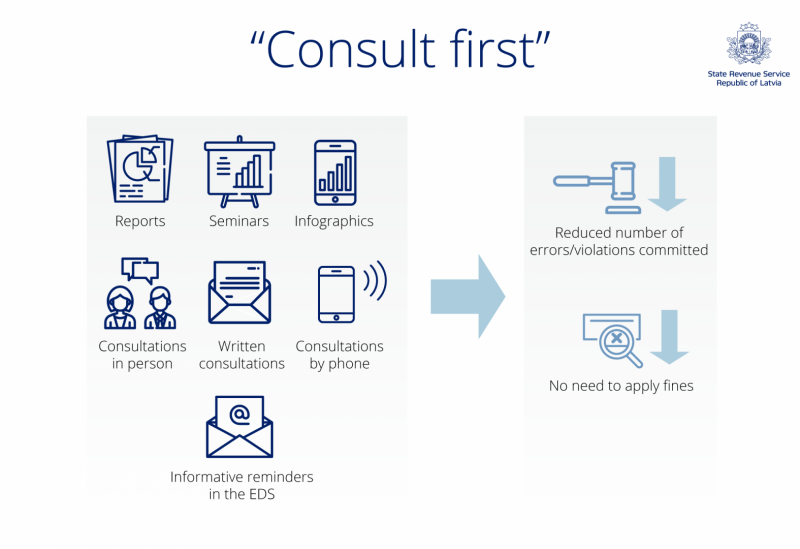

“Consult first” in the State Revenue Service is based on the following key courses of the activity:

- customer oriented activity - to preventively achieve mutual understanding and cooperation between the SRS and customers of SRS, as well as to promote performance of requirements stipulated by regulatory enactments, providing explanation of legal norms, in order not to establish violations for customers of the SRS and penal sanctions should not be applied;

- effective supervision - to implement the body of control measures, in order to ensure compliance with requirements set by regulatory enactments, informing customers of the SRS regarding the established violations/ non-compliances, at the same time giving recommendations and giving a possibility for customers of the SRS to eliminate the violation/non-compliance within the set term.

In order to receive more detailed information about the issues, being under the competence of the SRS, please, turn to any customer service centre or contact us electronically, as well as in writing by submitting a submission to any Customer Service Center or sending your question via mail.

The State Revenue Service issues written statements. A statement is a way, how a natural person may find out the opinion of the SRS about the application of legal norms on taxes in a certain situation. SRS prepares a statement within one month, but a taxpayer has to take into account that, when preparing the statement, in case of need the SRS may request additional information from the taxpayer or request for support from other authorities, therefore in such cases it is not possible to determine the precise term for providing a statement.

This is a general description, provided for an informative purpose, and does not have any legal force. In case of application you shall act in accordance with the regulatory enactment. In case of any questions, please, contact with the State Revenue Service of Latvia.