Upon receipt of a notification from Latvijas Pasts, courier or express mail service provider (hereinafter – supplier) with the indication ‘Consignment to be cleared’, a private individual can choose how to complete the customs formalities:

- to authorise the supplier to complete the customs formalities (paid service) in accordance with their conditions (for example, you may consult the information provided on the website of Latvijas Pasts);

- to authorise a customs representative providing services related to the completion of customs formalities, for example, a customs broker (paid service);

- to complete and lodge the simplified Import customs declaration for postal consignments themselves by logging on to the EDS. This declaration may be lodged provided that the total value of the goods contained in the consignment does not exceed EUR 1000, the weight does not exceed 1000 kg and the goods are listed in the Classification list (available in the EDS (added to the field "Description of goods" of Import customs declaration for postal consignments)). You can also access Classification list by clicking on the text "Choose the goods from the classification list" under the Calculator of taxes for postal consignments;

- to complete and lodge the standard Import customs declaration in the Electronic Customs Data Processing System (EMDAS) themselves by logging on to the EDS. This declaration has to be lodged if the goods contained in the consignment are not listed in the Classification list, the total value of the goods exceeds EUR 1000 or their weight exceeds 1000 kg.

The notification on the consignment to be cleared by customs drawn up by the supplier contains information required to complete the simplified Import customs declaration for postal consignments – number (number of the postal consignment /Tracking number), number of the temporary storage declaration, order number of the commodity as indicated in the temporary storage declaration, weight.

To complete and submit simplified Import customs declaration for postal consignments it is necessary:

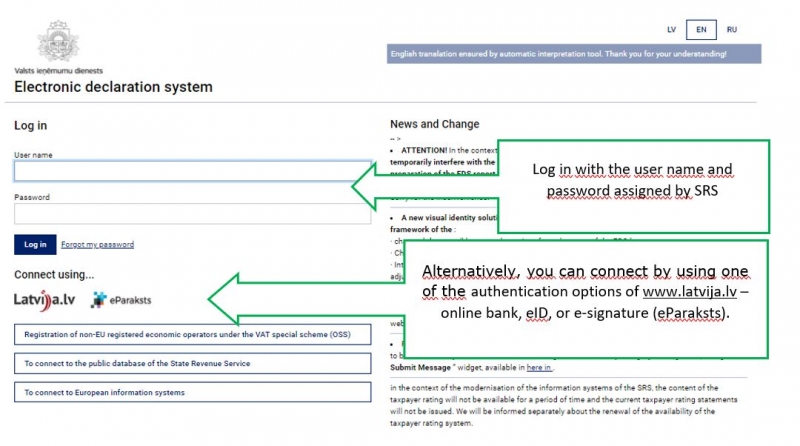

1) to log in to Electronic declaration system:

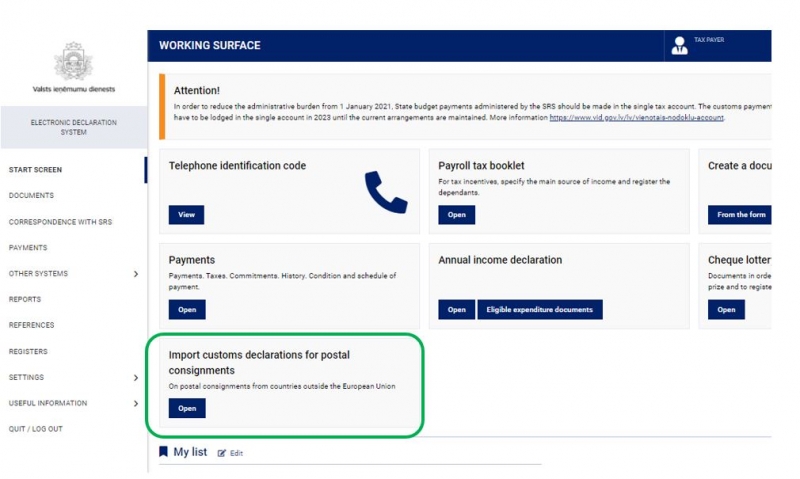

2) to choose Import customs declaration for postal consignments

To complete and lodge the declaration use this simple guide:

A separate Import customs declaration for postal consignments has to be lodged for each consignment received from the third countries. This means that even if you receive several consignments simultaneously containing similar goods (for example, food supplements) from the same consignor (for example, from ‘iHerb’) a separate declaration has to be completed and lodged for each consignment.

The consignment will be delivered or made available for collection only after the customs formalities will have been completed – completion of customs declaration (the status of the declaration has to be Goods have been released) and payment of taxes and duties.

Small parcels will be delivered to your mailbox by Latvijas Pasts, but in case of larger packages, you will receive further information from the post office. The consignment will be available to be picked up in your local post office only after the respective notification from Latvijas Pasts.

If the consignment is delivered by a courier or express mail provider, please contact them after the completion of the customs formalities in order to agree on the time and place of the delivery.