Registers him/-herself with the SRS within 10 days after entering into an agreement with an employee on the performance of work for remuneration. The agreement (copy) signed with the employee on the performance of work for remuneration must be submitted upon registration.

A domestic employee with an employer/foreign national is a natural who attained the age of 15 and is employed within the territory of Latvia by:

- an employer/foreign taxpayer, and the habitual residence of the employee is located in Latvia;

- a foreign employer, if the habitual residence of the employee is located in the Swiss Confederation, another European Union or European Economic Area Member State;

- an employer of another European Union Member State, the Swiss Confederation or European Economic Area Member State, with whom the employee has agreed on undertaking the duty to make mandatory contributions.

A domestic employee with an employer/foreign national is registered with the SRS within 10 days after entering into an agreement on the performance of work for remuneration (regardless of whether the agreement was signed in accordance with the legal acts of the Republic of Latvia or another country). The agreement (copy) on the performance of work for remuneration must be submitted upon registration.

If an employer of another Member State, which employs the employee, to whom the laws and regulations of the Republic of Latvia apply, upon agreement with the employee, registers with the State Revenue Service as a performer of mandatory contributions, submitting information regarding the name, registration number (in another Member State) and registered address of the employer.

Registration must be performed in person at any SRS Customer Service Centre.

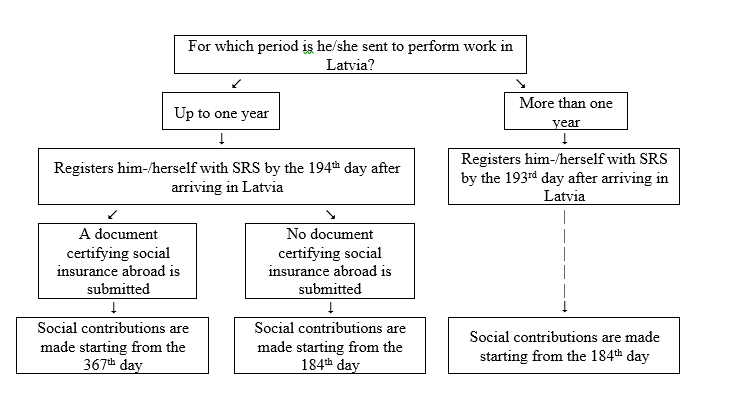

Registration terms of a foreign employee with an employer/foreign national

A foreign employee with an employer/foreign national is registered at the SRS within 10 days following the day of obtaining of the status in the Republic of Latvia, as well as submits documents specifying the following:

- the name and registered address of the employer in the country of delegation;

- the period for which the person is delegated to perform particular work in the Republic of Latvia (the start and end dates of the period concerned, month and year);

- subjection to the social insurance laws and regulations of the relevant country.

The State Revenue Service excludes an employer/natural person, a domestic employee with an employer/foreign national or a foreign employee with an employer/foreign national from the Register of Taxpayers as performers of mandatory contributions, based on a written application of the relevant person on exclusion from the Register of Taxpayers.

An employer (including the payer of microenterprise tax) shall register every employee with SRS, providing information on employees (Annex 1 to Cabinet Regulation No. 827 of 7 September 2010 “Regulations Regarding Registration of Persons Making Mandatory State Social Insurance Contributions and Reports Regarding Mandatory State Social Insurance Contributions and Personal Income Tax” (In Latvian)) within the following terms:

- for persons who start working: no later than within one day before the person starts his/her work, if information is submitted in paper form, or no later than within one hour before the person starts his/her work, if information is submitted electronically in the Electronic Declaration System;

- for employees who have changed or lost the status of an employee: no later than within three days after the change or loss of the status.

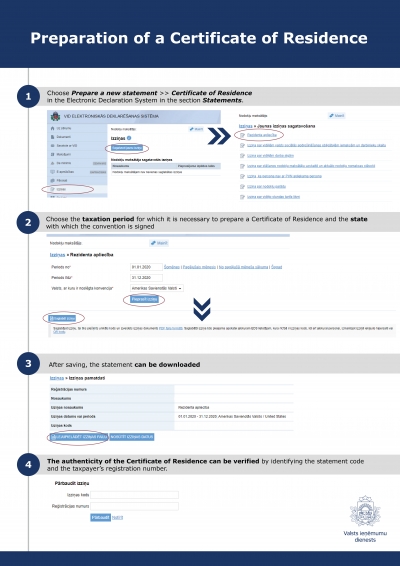

If income gained from abroad by a resident of Latvia is not taxable in the other corresponding state or is taxable at a reduced rate in accordance with the tax convention[2], then the resident of Latvia must prove residence when applying for tax exemption or tax relief in the other state. A Certificate of Residence can be prepared in the State Revenue Service Electronic Declaration System, which proves residency in Latvia when applying for tax relief as specified in the relevant tax agreement.

A resident of Latvia (recipient of income) can prepare and receive a Certificate of Residence (CoR) in the SRS Electronic Declaration System (EDS).

[2] Agreements for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion