The State Revenue Service (SRS) development strategy for 2023-2026 sets the institution's priorities, goals, and tasks. Among the priorities are more targeted service baskets based on taxpayer behaviour, including new benefits for honest fulfilment of obligations. SRS will review outgoing communication with clients more carefully, ensuring understandable and simpler language. Additionally, the service will increase attention on development of data analysis to identify negative trends at an early stage.

This was an unusual strategy development process for SRS: European Commission funding allowed for the tender to include international audit companies, resulting in the engagement of PricewaterhouseCoopers. This provided an opportunity to examine international practice and know-how in tax and customs matters. Simultaneously, strategy development took place in close cooperation with Latvian social and cooperation partners.

SRS Director General Ieva Jaunzeme noted: "This allowed us to look objectively at ourselves in the mirror and set realistic goals. The directions initiated in the previous strategic period, including the high degree of digitisation of services in which we have overtaken most of Europe and reached the level of the Nordic countries, a data-savvy approach to company segmentation, and changes in client-consulting culture have proven themselves to be a feasible and effective change for us. The foundation has been well laid. Now it needs to be expanded and developed. It is very important that the renewal of Latvia's tax policy takes place simultaneously with modern values so that the ship not only steers smarter towards the people, but that the cargo itself is also more suitable for them. We are currently looking forward to the work initiated by Saeima and the Ministry of Finance in this matter, and we will provide all necessary support. Easier tax administration is possible only if tax laws are simple and understandable."

Highlights: data analysis, client ratings, and clear language

SRS strengthened elements of the previous strategy, specifically data analysis, which made it possible to get to know Latvian companies and create suitable services for them. In essence – to support honest taxpayers and identify accurately and control in a timely manner dishonest ones. During the implementation of the new strategy, SRS intends to develop new services according to company ratings and develop advantages for honest companies. Work will also be started to understand SRS interactions and experience with other customers - employees and economic operators - more accurately, so that receiving SRS services will become more intuitive and easier to understand. Particular attention will be paid to the use of language in outgoing written communication: "We now receive thanks from clients for direct, understandable verbal consultations and a kind and humane attitude, but we still have room to grow in written communication," says I. Jaunzeme.

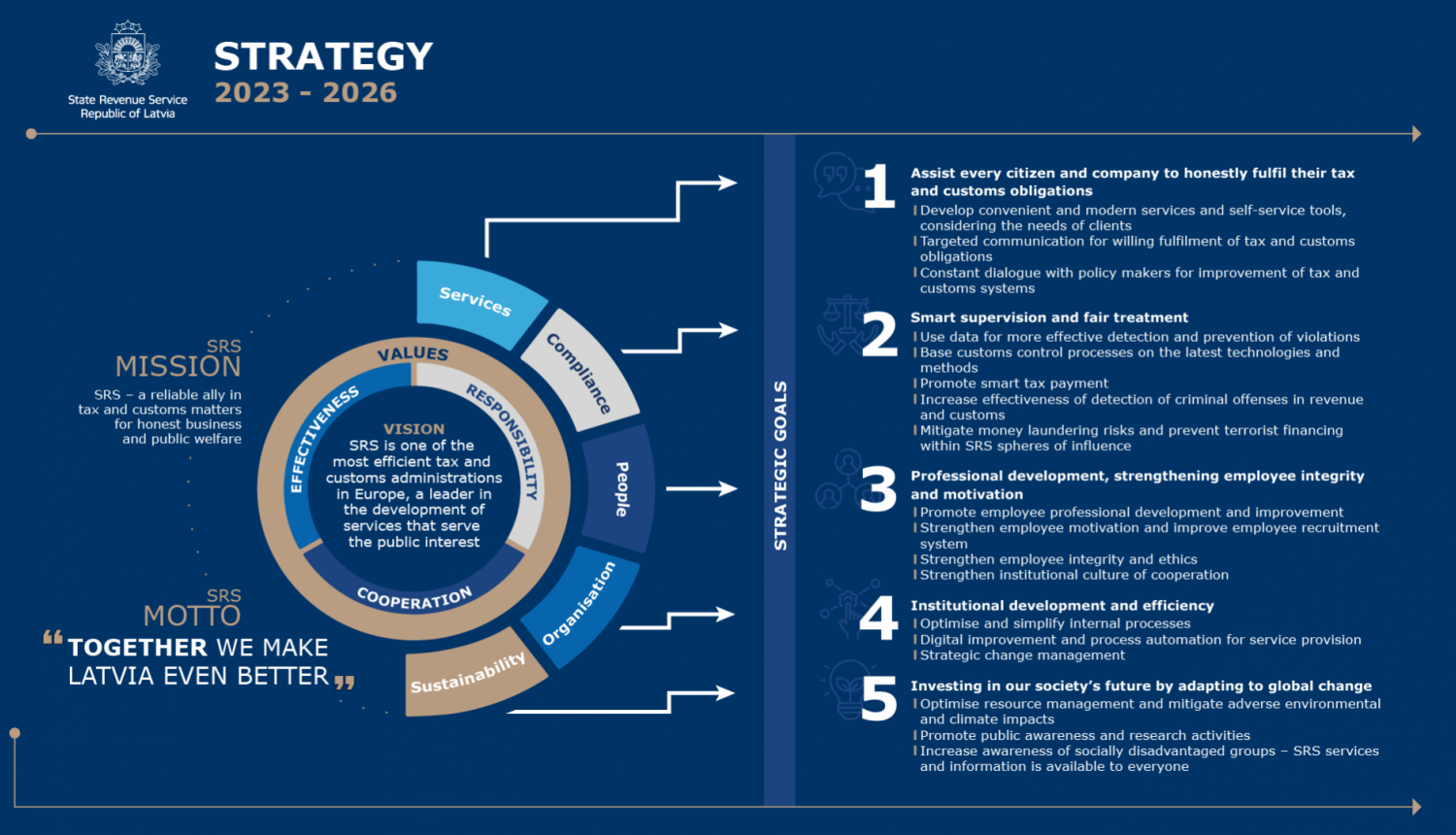

In general, the goals and tasks for the next four years are planned in five main directions. The first priority is services which help every citizen and company to honestly fulfil their tax and customs obligations. The second is compliance through intelligent supervision and fair treatment. The third is people by providing professional growth and strengthening employee integrity and motivation. The fourth priority is organisational development and efficiency and the fifth, sustainability, includes tasks related to investments in the future of society by adapting to global changes.

The SRS strategy plan for 2023–2026 can be found on our website: https://www.vid.gov.lv/en/strategy