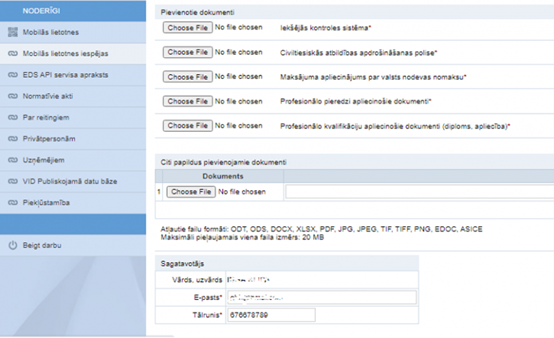

! Reminder: To extend an outsourced accountant's licence, the service provider must submit a renewed civil liability insurance policy[i] to the State Revenue Service every year through the Electronic Declaration System (https://eds.vid.gov.lv/login/ – Documents – From the form – Information to the State Revenue Service).

On 11 February 2021, Parliament adopted amendments to the Accounting Law, which provide for licensing of outsourced accountants. Licensing began on 1 July 2021; licences are issued by the State Revenue Service (SRS).

A public register of outsourced accounting service providers has been created, maintained in the SRS public database, allowing users to verify the right of a person to provide outsourced accountant services.

An outsourced accountant's licence can be obtained by individuals or enterprises registered with SRS.

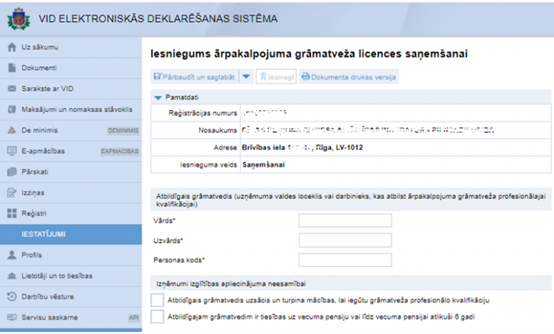

An enterprise needs only one licence for the company, not for each individual accountant employed by the company. To receive such a licence, one person in the company must be the responsible accountant who meets the statutory experience (minimum three years accounting experience) and relevant education (minimum first-level professional higher education or academic bachelor's degree in accounting, economics, management, or finance) requirements. The responsible accountant may also be a board member.

The law provides for exceptions for old-age pension recipients or those who have six years or less left until retirement as well as students. Pensioners and almost pensioners who have relevant experience as an accountant can receive a license that is valid until 1 July 2027.

If a person has accounting experience but not the required education, they can pursue their education and apply for a licence that will be valid until 1 July 2025. However, proof of continued education must be submitted to SRS every year by October 15.

[i] Accounting Law Section 39(4)